Inflation

Inflation is the increase in the prices of goods and services over time and when moderate is healthy for economic activity.

Using 2015 as the base year the annual inflation rate in Germany averaged 1,786% between 2002 and 2022, yet since 1992 has been alarmingly low and therefore jointly responsible for leading the economy into another crisis, fuelled by recent events such as COVID-19 and the current war in Europe. Consequently, inflation has rocketed from 0.5% in 2020 to 6.9% in 2022 with serious impacts on the value of money and aftermaths no economist is currently able to predict.

How inflation affects Savings

Over time, inflation reduces the value of our savings as prices increase.

If exactly 10 years ago you had stashed 10,000€ in cash at home, considering Germany's very moderate average inflation rate of 1.786% per year during this period, today you would realise that not only its net worth has shrunk to 8,378€, but the prices too have increased exponentially. An item/ service available for 10,000€ then, costs 11,937€ at today's rate!

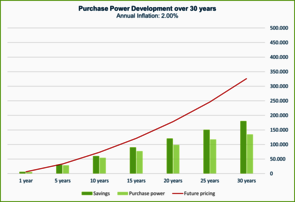

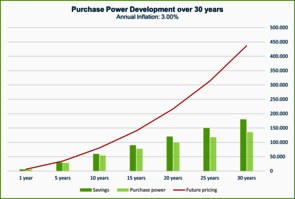

Without taking appropriate countermeasures the depreciation effect inflation has is not negligible therefore, the longer your money is not in cirrculation, the bigger your loss will be, demonstrated in the below charts.